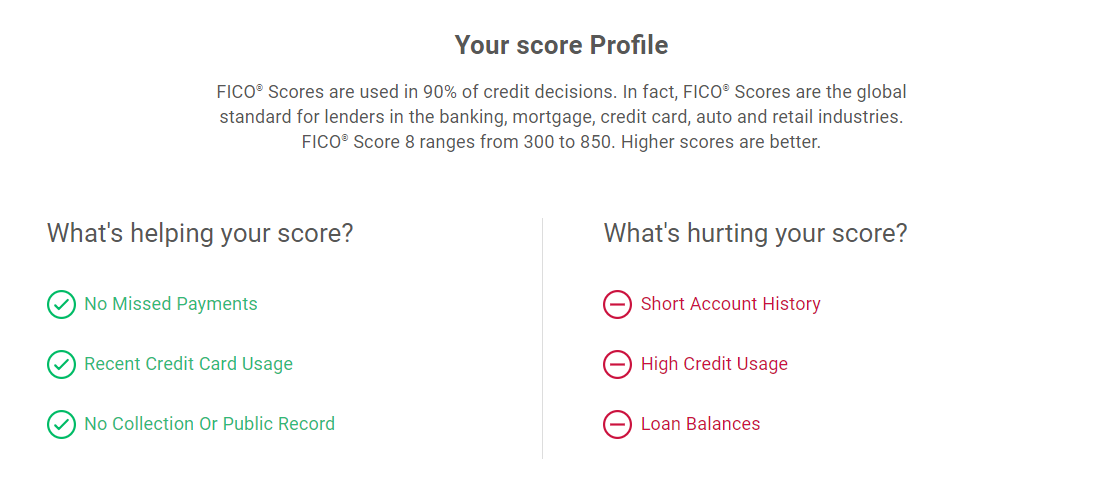

Think of your FICO Score of 637 as a springboard to higher scores. It will not be a favorable interest rate and you will need to show a good monthly income along with a large down payment.

A credit score of 637 isnt good Its not even fair Rather a 637 credit score is actually considered bad according to the standard 300 to 850 credit- 8.

. Loans and Credit You Can Get with a 637 Credit Score. You will also be able to get a credit card for people with fair credit. Some companies may approve anyone over 600.

This can help potential borrowers who are worried about getting denied because. In comparison if you can. You should be able to get a car loan with a 637 credit score without a problem.

Raising your credit score is a gradual process but its one you can begin right away. Thats where the Auto Loan Application Helper comes in handy. That means more risk to the lender.

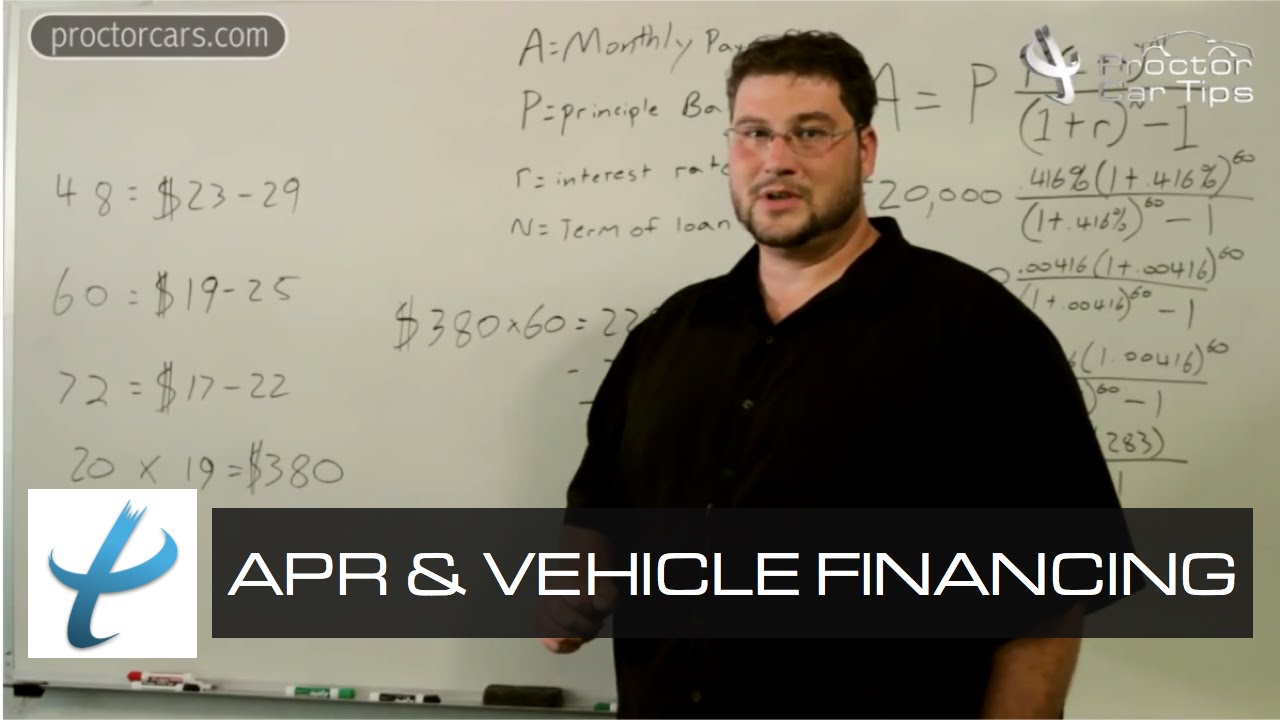

Individuals with a 637 FICO credit score pay a normal 94 interest rate for a 60-month new auto loan beginning in August 2017 while individuals with low FICO scores 500-589 were charged 148 in interest over a similar term. 637 credit score car loan options. Because while there isnt technically a minimum credit score needed to qualify the low score may not instill enough confidence in a lender to approve your application.

It might depend on whether you wantneed the 8K for auto or personal loan. A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 364 or better or a used-car loan around. If you can raise your credit score getting a car will be much easier.

If you are able to get approved for an auto loan with a 637 score it could be expensive. Rebuilding Your 637 Credit Score. 6 Best Auto Loans for Bad Credit.

The table below shows the average auto loan rate for new- and used-car loans based on credit scores according to Experian data from the second quarter of 2020. For instance if you are looking for loan from a car company they have a range of credit scores they are more likely to approve. Get the Best Car Loan.

Approximately 27 of consumers with credit scores in the Fair range are likely to become seriously delinquent in the future. Can I buy a car or get a credit cardYou applied for a home or car loan and in t. Qualifying for an auto loanthat is being loaned the money to purchase a car as opposed to renting or hiring a car for a day or twocan be difficult with a credit score of 637 or similar.

Network of dealer partners has closed 1 billion in bad credit auto loans Specializes in bad credit no credit bankruptcy and repossession In business since 1999 Easy 30-second pre-qualification form Bad credit applicants must have 1500month income to qualify Click here for application terms and details. A score of 637 may get you an interest rate of between 1192 percent and 468 percent on a new car loan. When borrowers have lower credit scores lenders raise their APR to cover the risk involved in extending the loan.

The average rate for a used car loan in the 630 to 639 credit score range is 908 4013 higher than the average rate for a new car. As long as your ratings are within what the three significant consumer credit bureaus consider the highest possible variety youll be in an excellent placement to get the very best rates of interest. Deep subprime 300500 Subprime 500600 Nonprime 600660 Prime 661780 Super prime 781850 New.

Truthfully people can get a car loan with almost any credit scorethe difference will be what kind of interest rate you can secure. A 637 credit score can be a sign of past credit difficulties or a lack of credit history. The highest possible credit score you can get with both primary scoring versions is 850.

I was approved in August 2008 admittedly just before the huge changes in credit landscape for 16K through Wachovia with scores that were just barely over 600. Very couple of individuals do. Such a score will make it difficult to get approved for a decent loan or line of credit and could even prevent you from renting an apartment or landing certain jobs.

A credit score in the low 600s will usually be acceptable to get a car loan. It allows users to search for loans by location and time of application. If you do not have best scores today dont panic.

How to improve your 637 Credit Score. Since a 637 credit score is categorized as nonprime your interest rates are likely to fall between 632 and 977. How to Improve a 637 Credit Score.

If a credit check is required in order to be approved for an auto loan it is advisable to make sure that your score is high enough before you apply. 637 CREDIT SCORE. A 637 Credit Score means.

Knowing your credit score before you start researching makes it easier to narrow down the types of loans you may qualify for. What Does a 637 Credit Score Mean. If you do qualify youll end up paying more money for your credit or loan because your lender will charge you a higher interest rate.

A score of 637 may get you an interest rate of between 1192 percent and 468 percent on a new car loan. In comparison if you can improve your 7. A credit score of 637 isnt good Its not even fair Rather a 637 credit score is actually considered bad according to the standard 300 to 850 credit-score scale.

Evaluate Your Credit Report - Pull your credit report and identify all negative harmful items thats keeping your 637 score suppressed. Car loan rates by credit score. EQ FICO rating 637 what are my chances.

A credit score of 600 wont necessarily keep you from getting an auto loan but its likely to make that. Having a 637 credit score makes it harder to get approved for a loan or a new line of credit as shown in the table below. Credit scores in the Fair range often reflect a history of credit mistakes or errors.

Whether youre looking for a personal loan a mortgage or a credit card credit scores in this range can make it challenging to get approved for unsecured credit which doesnt require collateral or a security deposit. Rates are higher for used cars because their value is lower. A Credit Repair company like Credit Glory can.

49 Overall Rating Our Review. If the lender has to repossess your car it may be difficult for them to sell it for enough to cover your balance. It also figures to cost you thousands of dollars.

Some auto lenders will not lend to someone with a 637 score. Dont panic thoughyoull definitely be able to get an auto loan with a score of 637. Of course this also depends on marks on your report.

No matter what your credit score is shopping around for a car loan and comparing what each lender has to offer is a smart move. Many lenders have a credit score range that they stick within when supplying loans or a line of credit.

Instagram Post By Gifted Lit Nov 5 2021 At 2 48pm Utc Instagram Posts Instagram Money Saving Tips

Fico Credit Score Auto Loans Auto Financing Vehicle Apr

What Is A Perfect Credit Score Experian

4 Ways To Get Late Payments Removed From Your Credit Report Check Credit Score What Is Credit Score Credit Score

0 comments

Post a Comment